Understanding Insurance Claim Denials: What You Need to Know

Have you ever had an insurance claim denied? It can be frustrating and overwhelming. That’s why it’s crucial to understand insurance claim denials and how to navigate through them. This comprehensive guide will shed light on the common reasons behind claim denials, provide actionable steps to take when faced with one, and offer valuable insights to help you appeal the decision.

If you need compassionate legal assistance, contact Springs Law Group today to protect your rights and maximize your chances of a successful appeal.

What is an Insurance Claim Denial?

An insurance claim denial occurs when an insurance company refuses to pay a claim made by a policyholder. It can be a frustrating and disheartening experience, leaving individuals without the compensation they need and deserve. Insurance claim denials can happen for various reasons, including policy exclusions, insufficient evidence, or administrative errors. Essentially, it means that the insurance company has determined that the claim does not meet the criteria or conditions outlined in the policy. Understanding the reasons behind claim denials is essential for individuals to navigate the process effectively and seek appropriate recourse to protect their rights and financial well-being.

Common Reasons for Insurance Claim Denials

Insurance claim denials can occur for a variety of reasons, and it’s important to be aware of the common factors that lead to such rejections. Understanding these reasons can help policyholders anticipate potential issues and take proactive measures to prevent claim denials.

Here are some of the most common reasons why insurance claims get denied:

- Policy exclusions: Insurance policies often have specific exclusions that limit coverage for certain situations or conditions. Reviewing your policy thoroughly is crucial to understand what is covered and what is not. Claims that fall under excluded categories will likely be denied.

- Lack of documentation: Insufficient or inaccurate documentation is a common reason for claim denials. Insurance companies require detailed evidence to support the claim, such as medical records, police reports, or invoices. Failure to provide proper documentation or missing essential information can result in the rejection of your claim.

- Pre-existing conditions: Some insurance policies have limitations on coverage for pre-existing conditions. If your claim is related to a pre-existing condition not covered by your policy, it will likely be denied. However, certain cases may have exceptions or specific provisions, so it’s important to review your policy carefully.

- Late reporting: Promptly reporting incidents to your insurance company is vital. Delays in reporting can raise suspicions and give the insurer a reason to deny the claim. Be aware of the reporting deadlines outlined in your policy and ensure you notify your insurance company promptly.

- Misrepresentation: Providing inaccurate or incomplete information when filing a claim can lead to denial. It’s essential to be honest and transparent throughout the claims process. Failing to disclose relevant information or provide false details can result in rejection.

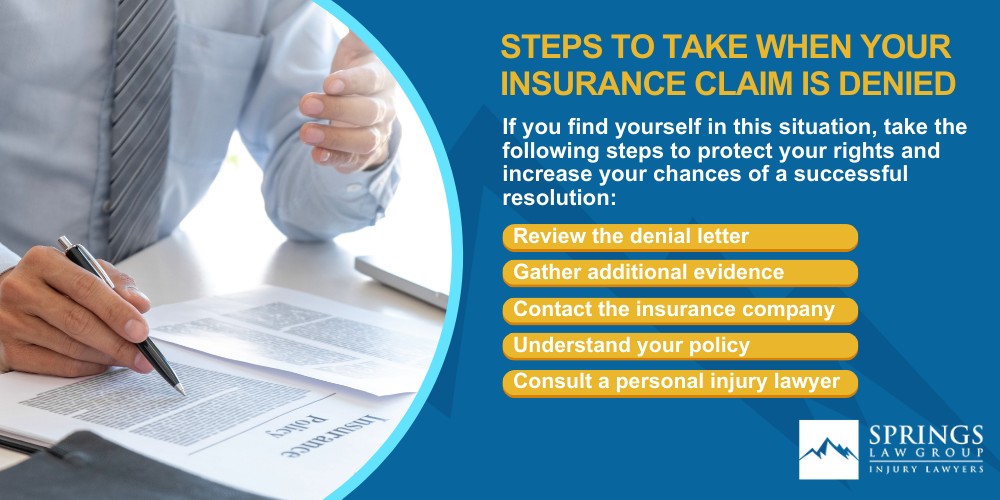

Steps to Take When Your Insurance Claim is Denied

Discovering that your insurance claim has been denied can be frustrating, but it doesn’t necessarily mean the end of the road.

If you find yourself in this situation, take the following steps to protect your rights and increase your chances of a successful resolution:

- Review the denial letter: Carefully read the denial letter provided by the insurance company. Understand the specific reasons for the denial and the policy provisions cited. This information will be crucial in building your case moving forward.

- Gather additional evidence: Assess the evidence you provided initially and identify any gaps or weaknesses. Collect any other supporting documentation that strengthens your claim. This may include medical records, repair estimates, or expert testimony.

- Contact the insurance company: Reach out to your insurance company to seek clarification on the denial. Ask for a detailed explanation of their decision and any specific information or documentation they require to reconsider your claim. Keep records of all communication for future reference.

- Understand your policy: Thoroughly review your insurance policy to ensure you understand the coverage and limitations. Check if the denial aligns with the policy provisions. Consider seeking legal advice if there are any discrepancies or if you believe the denial is unjust.

- Consult a personal injury lawyer: Engaging the services of a knowledgeable personal injury lawyer experienced in insurance claim denials is highly recommended. They can evaluate your case, guide you through the appeals process, and advocate on your behalf.

Remember, time is of the essence when dealing with a claim denial. Insurance policies often have strict deadlines for filing appeals, so act promptly.

Contact Springs Law Group Today

Facing an insurance claim denial can be a challenging experience. However, understanding the reasons behind claim denials and taking appropriate action can make a significant difference. By seeking guidance from a Colorado Springs insurance claims lawyer, you can navigate the appeals process with confidence.

At Springs Law Group, we are here to provide you with quality legal assistance. We will handle your insurance claim denial so you don’t have to. You can rely on us.

Contact us today to protect your rights, maximize your chances of a successful appeal, and ensure your voice is heard in the face of an insurance claim denial.