What Has to Be Paid Out of a Car Insurance Settlement?

After someone gets into a motor vehicle accident in Colorado, they often must go to the hospital and undergo medical care for their injuries. This is sadly a reality for victims who were simply minding their own business when a negligent or careless driver struck them. A lot of injury victims fail to understand just how their insurance claim will be processed, and this can lead to confusion and disappointment later when they finally are compensated for their injuries.

To dispel some myths and help you understand what must be paid out of your car insurance claim, the attorneys of the Springs Law Group are here to help.

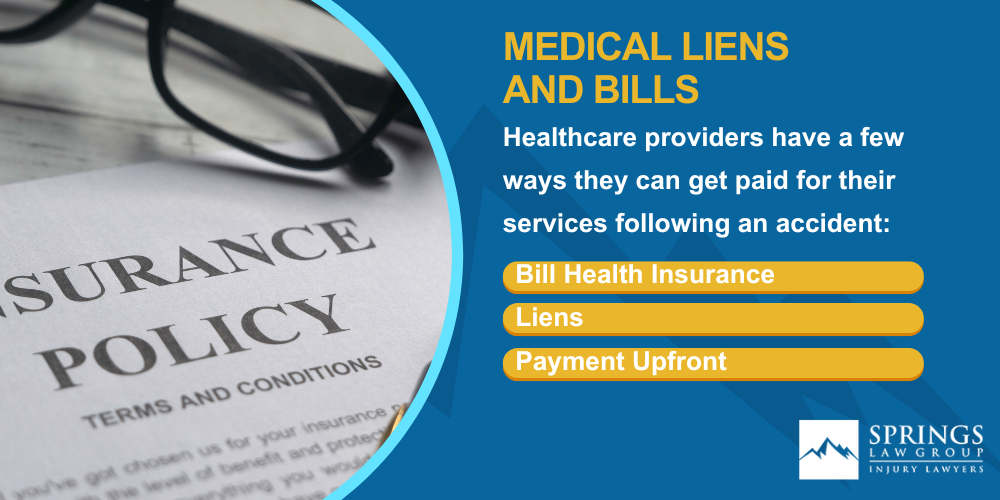

Medical Liens and Bills

First of all, if you’ve been seriously hurt in a car accident, you will almost certainly have medical bills. Healthcare providers have a few ways they can get paid for their services following an accident.

- Bill Health Insurance – If your providers bill your health insurance, then you will only be responsible for copays and deductibles up-front at the time of service. Per the contract with your health insurance company, most of the time they will not be able to seek a balance later. They are usually required by contract to accept the health insurance payment as payment in full. But your health insurance company may need to be reimbursed. More on that below.

- Liens – Some providers, especially those who regularly treat accident victims, will choose not to bill health insurance. Instead, they hold their bills and place a lien on your case. This just means their bill must be paid from your verdict or settlement funds. This is not necessarily a bad thing, as some people may find it hard to otherwise seek treatment. This happens when your insurance is not widely accepted or when providers are simply unwilling to bill health insurance.

- Payment Upfront – Finally, some providers may work out a cash deal to be paid out of pocket for a reduced amount. Where offered, this can be a good option for those who can afford it.

Auto Insurance Liens

Sometimes your own insurance company will chip in to pay your bills. This is done through medical payments (an optional insurance you can add to your policy). If they do, your auto insurance will have a right to be reimbursed these funds if you end up recovering money from the at-fault driver.

Health Insurance Liens

If a health insurance plan paid medical bills, they will likely assert a lien for reimbursement. This is especially true of ERISA plans. These are usually offered by unions and large, self-insured employers.

Other Liens

There are lots of other liens that can be placed on a case, ranging from liens based on work injuries and liens for child support. Also, if you receive Medicare or Medicaid, these government programs will almost definitely request reimbursement for any funds they spent on your medical expenses.

How a Lawyer Can Help

Because there are so many liens and reimbursement rights, it’s very important to work closely with an attorney from the start of your case. An attorney from the Springs Law Group can carefully review your situation and notify all potential lienholders of their involvement.

There is nothing to fear from these reimbursements, so long as they are known and considered when negotiating. While you will have to pay back your providers and lienholders from your settlement, a skilled attorney can often minimize the impact by negotiating with these entities to get reductions for you.

For help after an accident in the Colorado Springs or Pueblo areas, call to schedule a free consultation today.